Key momentsThe USD/JPY has surged towards the 150.00 mark on Tuesday, rising by around 0.30%.The Bank of Japans forthcoming two-day meeting is under close scrutiny from market participants, who antici

USD/JPY Nears 150.00 Ahead of BoJ Meeting USD/JPY Nears 150.00 Ahead of BoJ Meeting

Key moments

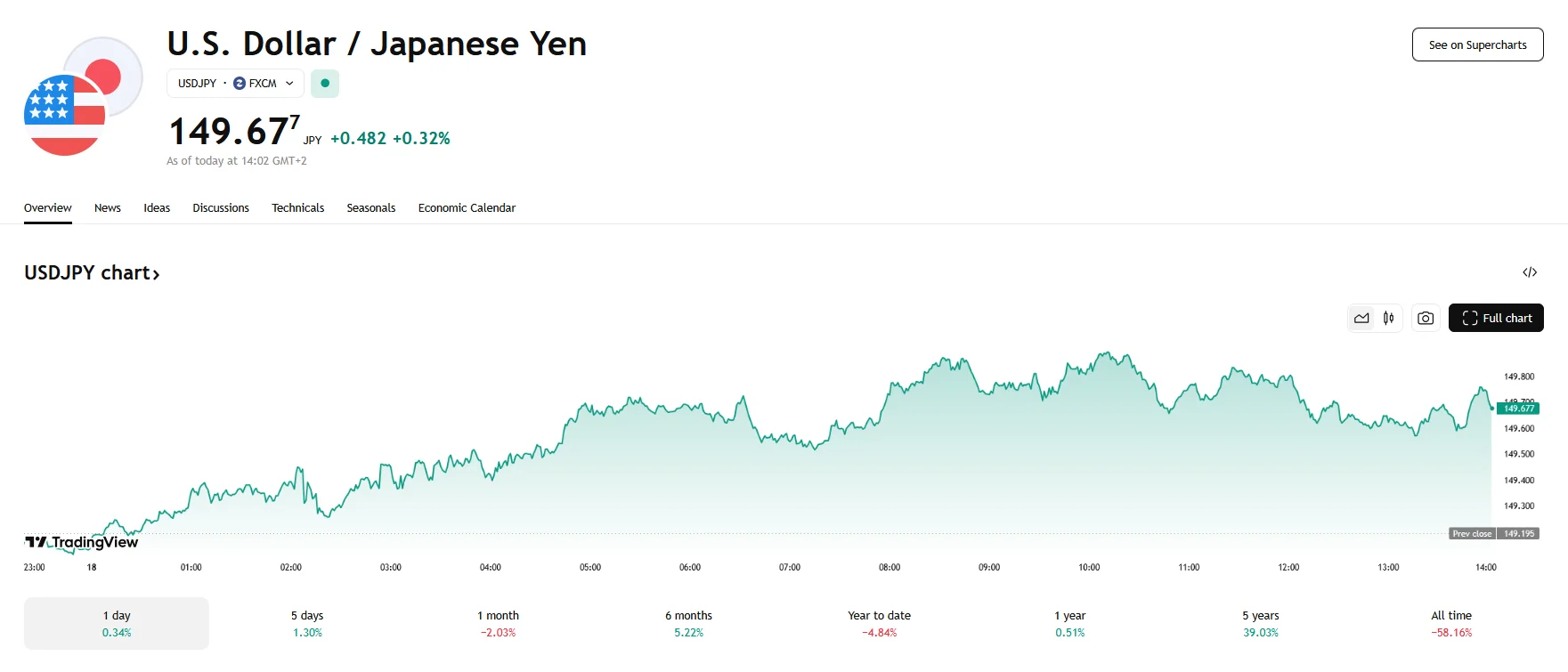

- The USD/JPY has surged towards the 150.00 mark on Tuesday, rising by around 0.30%.

- The Bank of Japan’s forthcoming two-day meeting is under close scrutiny from market participants, who anticipate possible further interest rate increases throughout the year.

- The U.S. Dollar’s recent rebound from a multi-month low has given additional momentum to the USD/JPY pair.

Market Eyes BoJ Decision, USD/JPY Climbs Amid Yen Selling Pressure

On Tuesday, the USD/JPY pair edged closer to the 150.00 level as the Japanese Yen experienced persistent selling pressure. This movement, reflecting an increase of just over 0.30%, underscores the current market dynamics influenced by both global economic factors and anticipation surrounding the Bank of Japan’s (BoJ) upcoming monetary policy meeting.

The Yen’s continued depreciation can be attributed to a prevailing positive risk sentiment in the market. Optimism stemming from China’s stimulus measures and hopes for a resolution to the conflict in Ukraine has diminished the appeal of the Yen as a safe-haven currency. Additionally, a modest recovery of the U.S. Dollar from its recent multi-month low has further contributed to the USD/JPY pair’s upward trajectory.

Market participants are keenly focused on the BoJ’s upcoming two-day meeting. Expectations regarding the BoJ’s stance are varied, with some anticipating continued interest rate hikes throughout the year. These expectations are bolstered by positive outcomes from the Shunto spring wage negotiations, indicating potential inflationary pressures.

Conversely, concerns about the economic repercussions of potential trade tariffs, particularly those linked to U.S. policies, are also influencing market sentiment. These concerns could potentially limit the Yen’s losses, as they might prompt the BoJ to adopt a more cautious approach.

Furthermore, the potential of further policy easing by the Federal Reserve (Fed) is also playing a role in shaping the USD/JPY pair’s movement. These expectations are capping the U.S. Dollar’s potential gains, thereby influencing the pair’s overall direction.

The USD/JPY pair’s recent breakout above key moving averages suggests a bullish trend, but the barrier of 150.00 remains a critical level to watch. A successful breach of this level could pave the way for further gains, while a failure to do so could indicate a potential reversal.