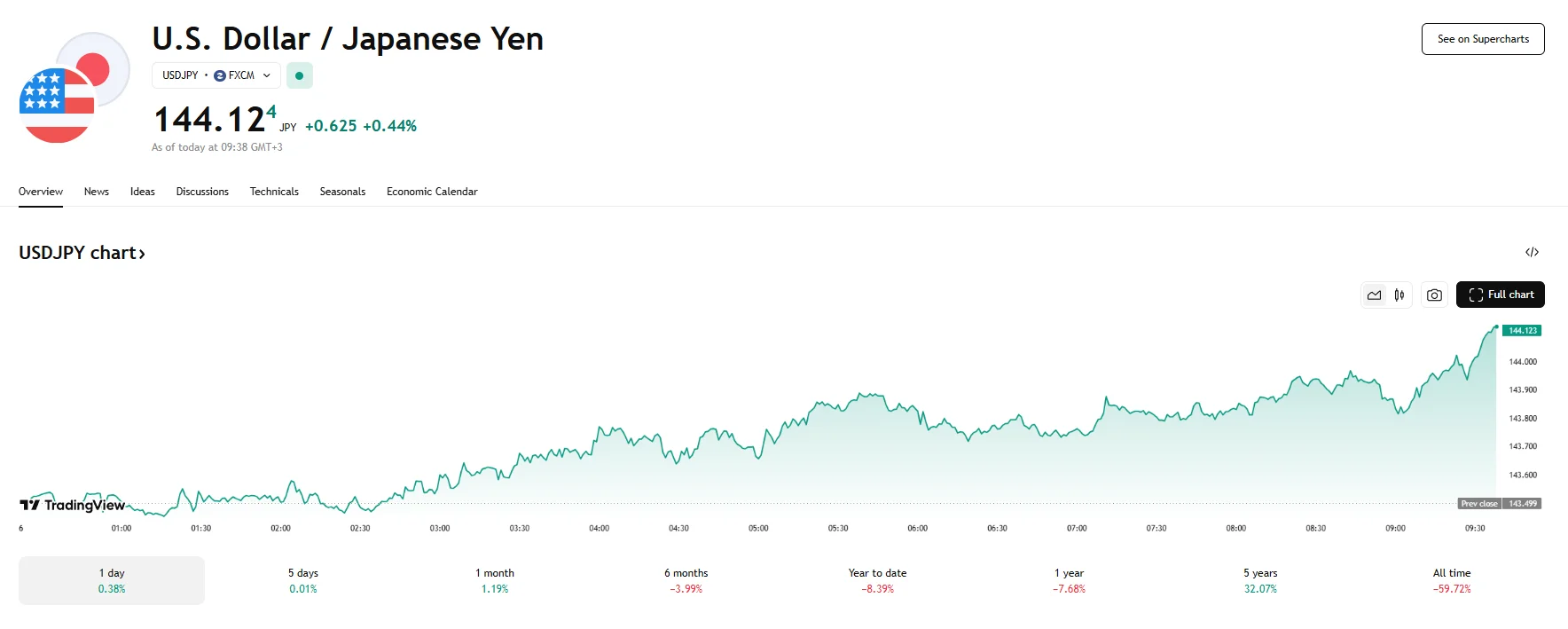

Key Moments:The yen depreciated against the US dollar for a second consecutive day, with the USD/JPY rising 0.44% to 144.12.April household spending fell by 0.1% in Japan.Safe haven demand diminished

USD/JPY Soars to 144.12 on Japanese Household Spending Decline of 0.1% USD/JPY Soars to 144.12 on Japanese Household Spending Decline of 0.1%

Key Moments:

- The yen depreciated against the US dollar for a second consecutive day, with the USD/JPY rising 0.44% to 144.12.

- April household spending fell by 0.1% in Japan.

- Safe haven demand diminished as risk appetite grew on expectations for renewed US-China trade negotiations.

USD/JPY Nudges Above 144.00 as Sentiment Weighs on JPY

The USD/JPY advanced by over 0.40% on Friday to reach an intraday high of 144.12 as confidence in the yen fell following the release of disappointing economic data. The dollar, meanwhile, staged a recovery from yesterday’s slump as renewed hopes of progress in US-China trade negotiations served to make US assets more appealing.

BoJ Move May Limit JPY Weakness

According to the latest figures, Japanese household spending dipped by 0.1% in April. This marked a decline from last year’s jump of 2.1%. The benchmark also fell 1.8% from last month. Further exerting pressure on the yen was disappointing real wage data, which exacerbated unease over consumer demand and a potential recession.

Despite the current selling momentum in the yen, markets are maintaining expectations that inflationary pressures could prompt the Bank of Japan to proceed with additional rate hikes this year. Persistent global tensions also present an overhang that may temper risk appetite and moderate any sharp USD/JPY gains.

Policy Outlook and Trade Developments Shape Market Direction

Market sentiment surrounding the US dollar rose ahead of Friday’s Nonfarm Payrolls report thanks to a recent phone conversation between US President Donald Trump and Chinese President Xi Jinping. The two leaders agreed to arrange a new round of trade talks, with Trump describing the call as highly focused on trade and producing a favorable outcome. At present, the US Dollar Index is trading near the 99.00 mark.

Gains remain limited by growing forecasts of a possible Federal Reserve rate cut, however. Additionally, investor worries about the US fiscal outlook may keep the greenback constrained.