Key momentsActive XRP addresses plummet from 530,000 to 123,000, indicating a sharp decline in investor participation.XRP holds above $2.00, with $2.14 acting as a crucial support level despite a 22%

XRP Stays Above $2.00, but Liquidity Concerns Cloud Outlook

Key moments

- Active XRP addresses plummet from 530,000 to 123,000, indicating a sharp decline in investor participation.

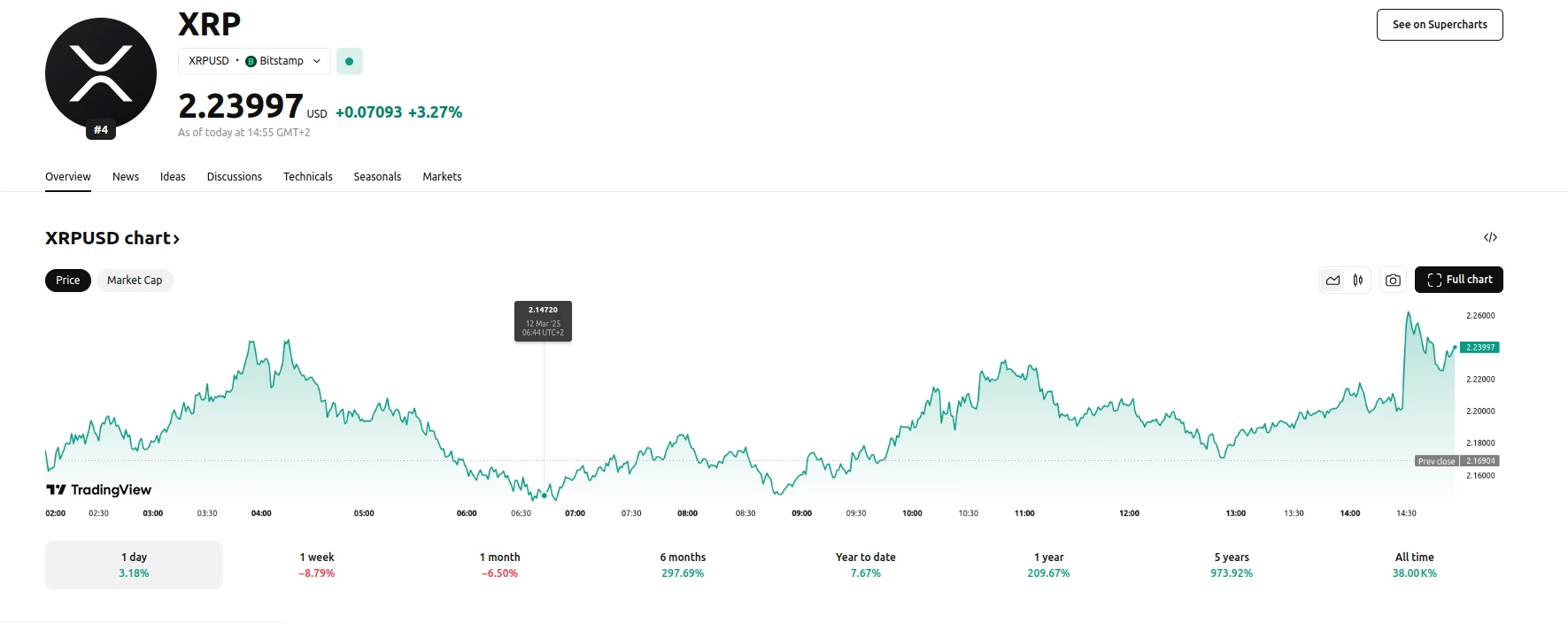

- XRP holds above $2.00, with $2.14 acting as a crucial support level despite a 22% correction.

- XRP faces resistance at $2.33, while a drop below $2.14 could lead to a further decline to $1.94.

Declining Investor Participation and Market Uncertainty Hamper Recovery Prospects

XRP has navigated a period of significant price volatility, maintaining a position above the crucial $2.00 mark despite a substantial 22% correction. However, the altcoin’s recovery prospects are clouded by declining investor participation and ongoing market uncertainty. The sharp decrease in active addresses, from a peak of 530,000 to just 123,000, signals a notable reduction in investor interest and a corresponding decrease in liquidity. This decline reflects a broader hesitancy among investors, influenced by bearish market cues and a lack of clear momentum.

The reduction in investor activity has created challenges for XRP’s price stability. With fewer active participants, the market experiences reduced liquidity, making it more difficult for the altcoin to sustain upward momentum. Despite these challenges, long-term holders (LTHs) have played a vital role in supporting XRP’s price, maintaining their positions and preventing further declines. The MVRV Long/Short Difference indicates that LTHs are currently holding significant profits, and their continued holding behavior is crucial for maintaining the price above critical support levels, serving as a vital stabilizing force.

Currently, XRP is trading around $2.17, maintaining its position above the key support level of $2.14. However, the altcoin faces resistance at $2.33, and breaking through this barrier may prove difficult given the current market conditions. The prevailing uncertainty suggests that XRP is likely to consolidate within the range of $2.14 and $2.33. A breakout in either direction will depend on the broader market’s ability to regain momentum. Should XRP fall below $2.14, a descent to $1.94 is possible, which would likely indicate a bearish turn and complicate future recovery efforts.